Count on our vetted and FinCen.gov approved service for seamless, real-time API submissions.

350

days

Businesses established before 2024 have until March 21st, 2025, to achieve CTA compliance.

30

days

If you created a new business in 2025, you have 30 days to become CTA compliant.

Legal Solutions Made Easy

What is the Corporate Transparency Act?

Starting January 1, 2024, the Corporate Transparency Act (CTA) will require most U.S. companies to share basic information with the government. This law aims to stop money laundering and terrorism funding.

Understanding the Corporate Transparency Act is crucial because not complying with this rule can result in significant fines, even if you are unaware of it.

What info is needed to file for CTA compliance?

WE'VE GOT FUTURE UPDATES HANDLED

Make updates to your CTA filing for FREE.

Other services might charge you for making changes to your Beneficial Ownership Information (BOI) report for CTA compliance, but we offer you one year of unlimited CTA updates at no cost.

By law, if any details from your initial filing change, such as an address update, you must submit an updated report within 30 days of the modification to avoid fines.

We make it super easy to update your information and resubmit the BOI report for compliance with the Corporate Transparency Act. Stay compliant with our hassle-free, free-of-charge update service.

TESTIMONIALS FROM HAPPY CLIENTS

What our customers are saying about us.

JESS F.

PAUL G.

MEGHAN S.

STELLA L.

RASHAD C.

STEFANY T.

JAY B.

SARA K.

MARK V.

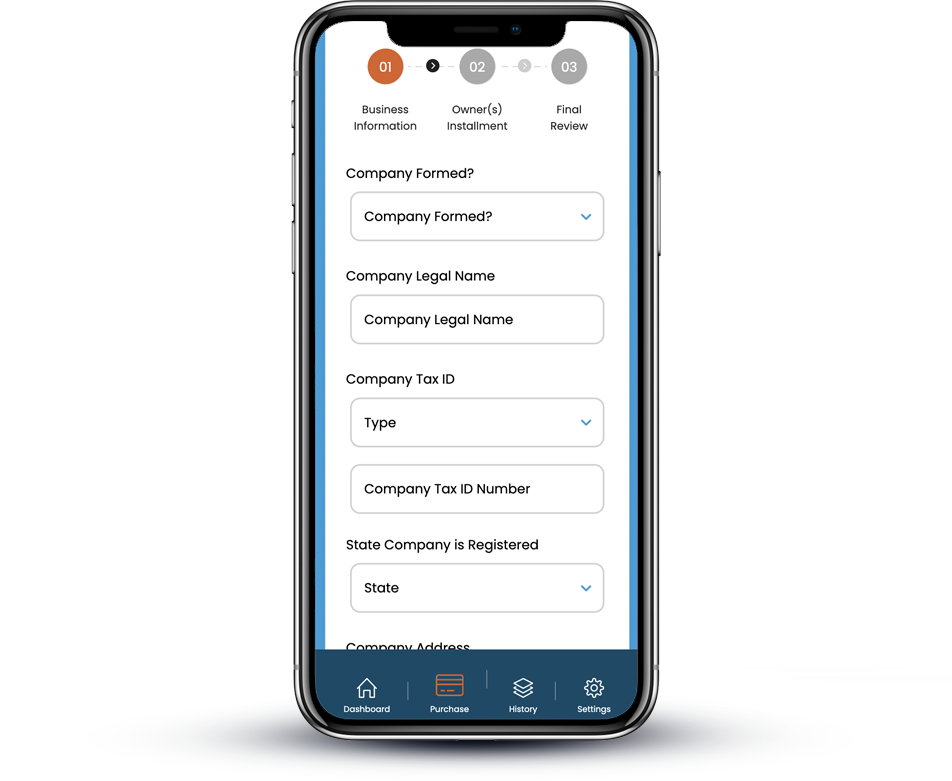

USER-FRIENDLY LEGAL SERVICES MADE EASY

Built with your convenience in mind.

Our site and services are optimized for mobile use, allowing you to effortlessly review, fill out, and upload the necessary data for your CTA filing.

Get compliant for $99!